The number of digital transactions in Singapore hit a record high in early 2020 with the use of digital payments doubling in the first 4 months.

Between January and March 2020, DBS Bank saw a historic surge in the number of digital transactions -- 100 million more than that in 2019 during the same period.

United Overseas Bank Ltd (UOB) saw a 40% increase in purchase of gold on its digital platforms in March 2020. |

Rapid digitalisation has led to greater customisation of services with banks and financial institutions heavily investing in ABCD (AI, Blockchain, Cloud Computing, and Big Data) technologies. It has also fuelled a surge in demand for skilled PMETs, with an increase in 2,200 net jobs in the sector in 2020.

Building on last year’s job growth, the financial sector is set to add 6,500 new jobs in 2021 with technology roles claiming a quarter of the job roles. As per the Monetary Authority of Singapore (MAS), around 2,500 to 3,500 tech jobs will be created in this sector on a yearly basis, over the medium term.

However, Singaporeans account for just one-third of these job roles.

In a webinar in May 2021, Mr Ravi Menon, Managing Director, MAS, underlined the need to create a strong local talent pipeline in tech to increase local share in emerging job roles. A month later, MAS and the Institute of Banking and Finance (IBF) extended enhanced training support measures for local workers and financial institutions till 30 June 2022.

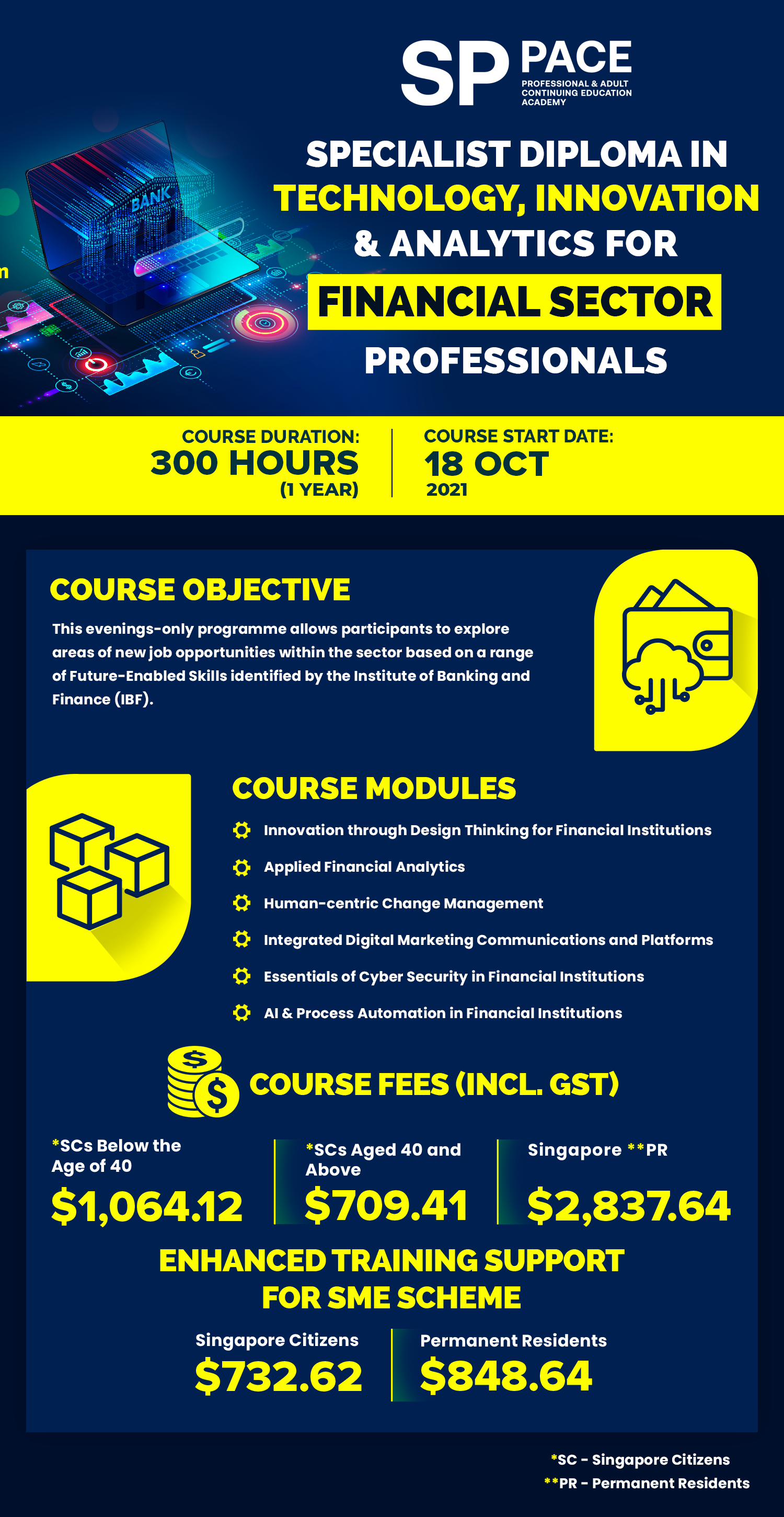

To help PMETs take advantage of the new job opportunities in this sector, SP PACE Academy presents a 1-year part time programme. The Specialist Diploma in Technology, Innovation & Analytics for Financial Sector Professionals will train mid-level managers and experienced professionals in Future-Enabled Skills identified by IBF. With 2,860 out of the 6,500 new job roles open to mid-career professionals with no tech experience, this programme can certainly help them bridge their skill gap.